How we measure financial returns says a lot about our values, just as it does with social and environmental returns. We can’t ignore finan-

cial measures—even in nonprofit endeavors— but we have to be aware of what to measure and what not to measure. Sustainability asks us to consider a host of nonfinancial issues in designing and developing new solutions. These may not be able to be quantified in numbers or currency. Regardless, even when they can’t be represented in financial terms, they are still important.

Currently, economic activities are measured in time-honored ways, such as assets, liabilities, expenses, profits, interest, and so on. These, however, are based on assumptions about how markets work that date back decades and ignore environmental and social values. For example, our markets assume that the value of money decreases over time. This is why interest exists: to compensate for getting back less value than what you loaned. However, this doesn’t have to be the case. It’s simply an agreement in our economic models. We could have just as easily created a model that assumed the opposite. Again, this is about design.

A common approach to business and finances in the West was famously described by Milton Friedman: “The business of business is business.” This is an attempt to dismiss social and environmental concerns from business and the marketplace, partly because it’s so difficult to measure and integrate these issues. This attitude has dismissed businesses from any requirement of responsibility based on social and environmental outcomes and their effects.

A common approach to business and finances in the West was famously described by Milton Friedman: “The business of business is business.”

In my opinion, this is a failed frame, partly because it simply hasn’t been the case that companies have behaved exemplarily in these aspects, and partly because social values have always been in the marketplace, just undercover or under special circumstances. Consider, for example, a U. S. company trying to argue that it should be able to sell key strategic products (computers, munitions, energy, ma-

terials, services, etc.) to an enemy during war. If Milton Friedman were right, no free-market capitalist should have a problem with this proposition. However, most businesspeople (conservative or not) would never agree to this.

As a result, the measures we use to assess financial progress are equally flawed in their assumptions. Economists call the deficiencies in their economic model externalities.[1] These externalities hide implausible assumptions such as “buyers make rational decisions” and “buyers make decisions based on perfect knowledge.” Only recently has the field of economics begun to correct these fallacies that figure into not only our prevailing economic theory and model but also our most popular calculations

and measures. As a result, our policy decisions reflect flawed assumptions and track inaccurate, and sometimes inappropriate, measures of success.

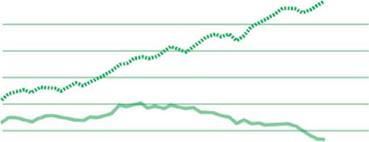

A good example of these popular measures is the Gross National Product (GNP). This measure is used as the chief indicator of a nation’s economic health. However, profound impacts that are seen as deleterious to the social fabric and quality of life of nations (such as divorce, natural disasters, environmental degradation, etc.) actually contribute to a better GNP. This is because the total cost of these circumstances isn’t calculated in anything but the narrowest financial terms. Instead, new (and probably still imperfect) measures, such as the Genuine Progress Indicator (GPI) attempt to compensate for the uncalculated social and environmental impacts.

A comparison of the GPI and GNP for the last 50 years, for example, shows a significant difference in their measures (see Figure 2.1).

£ per capita:

20,000—————————————————————————————

![]()

![]()

5,000 0

5,000 0

1950 1960 1970 1980 1990 2000

…… USA GDP (Gross Domestic Product)

— USA GPI (Genuine Progress Indicator)

FIGURE 2.1. /Ш http://www. flickr. com/photos/rosenfeldmedia/3259001512

GNP vs. GPI.

Putting all of these measures together requires a new model for accounting. Where organizations only need to track financial measures currently, new instruments like the triple bottom line require organizations to track measurements across all three categories. But, this is

still not enough. Simply tracking the numbers doesn’t mean they will be consulted. The integrated bottom line attempts to combine these values so that environmental and social values aren’t easily ignored. However, not only are there no standards for how to account for these other measures, but most companies don’t even track the data necessary to do so—yet.

Integrated Bottom Line

In the late 80s, environmentalists started urging companies to use a “triple bottom line” to manage profit while also protecting people and the planet. Unfortunately, this approach simply bolted the promotion of environment and social issues onto standard balance sheets as cost centers, reducing the traditional measure of profit.

A more useful approach is the “integrated bottom line,” a term coined by socially responsible investment expert, Theo Ferguson. This recognizes that profit is an important measure, but only one of many criteria that

Integrated Bottom Line (continued)

helps organizations provide enduring value. The Integrated Bottom Line approach integrates costs and benefits for social and environmental criteria into the traditional structure of the income statement and balance sheet, eliminating the separation of these issues and directly highlighting where the value of sustainable business impacts business performance and value:

• Raise profitability by cutting energy and materials costs in industrial processes.

• Drive innovation, leading to increased top-line revenues.

• Improve facilities design and management, and fleet management to increase effectiveness.

• Lead the effort and have first-mover advantage.

• Reduce risk and unbooked legal liabilities.

Integrated Bottom Line (continued)

• Improve access to capital.

• Improve corporate governance.

• Enhance core business value through better government and stakeholder relations.

• Build brand equity by differentiating product and service offerings and enhancing reputation.

• Build competitive advantage through increased market share.

• Increase a company’s ability to attract and retain the best talent and detract from lost knowledge and expertise or increased training costs from replacement personnel.

• Increase employee productivity and health.

• Improve communication, creativity, and morale in the workplace.

• Build better supply chain and stakeholder relations.

Integrated Bottom Line (continued)

Companies on the Dow Jones Sustainability Index have outperformed the general market by integrating the thinking behind the integrated bottom line across all aspects of their business. Recently, Goldman Sachs found that leading companies in environmental, social, and good governance policies outperformed the MSCI world index of stocks by 25 percent since 2005. Seventy-two percent of the companies on the list outperformed industry peers.[2]

3 Alderton, Margo, “Recent report finds corporations that lead in corporate responsibility also lead in the market,” Socially Responsible Investing. 07-11 17:57, also at www. csrwire. com/companyprofile? id=4489.

rent accounting of revenues, costs, employees, supply chains, etc., it proposes adding value criteria from market and competitors, governments, NGOs, and other stakeholders, as well as currently unaccounted values for things like product disposal (both costs and savings).

Other, new measures are being proposed (such as the Sultan of Bhutan’s Gross National Happiness indicator), but we need more proposals. We’ve yet to establish satisfactory measures that calculate total social and environmental costs in relation to traditional monetary costs, and until we do, we won’t have the tools necessary to make smart decisions about our futures.